How To Repair Your Credit Report

If y'all have recently pulled your credit report and noticed a charge-off in that location, you might exist wondering how to remove it from your report. Offset, know that a charge-off in your credit history is a major deal. It will near likely cause a large subtract in your credit score. Then if you don't take any steps to dispute it, the charge-off will stay on your credit written report for up to seven years.

Here are iii proven methods to remove a charge-off from your credit report:

- Negotiate A "Pay for Delete" & Pay The Creditor To Delete The Charge-Off

- Use The Avant-garde Method To Dispute The Charge-Off

- Take A Professional Remove The Charge-Off

i. Offer To Pay The Creditor To Delete The Charge-Off

Ane of the most constructive ways to get negative items removed from your credit written report is to pay the debt, in exchange for the creditor removing the charge-off from your credit report. With this method, you'd utilise your payment as leverage to convince the debt collector to help restore your credit. But this simply works on an unpaid charge-off. If you lot've already paid the charge-off only it'south still on your credit report, you actually don't accept whatsoever leverage to negotiate its removal.

Before You Pay the Charge-Off

Before you decide to effort this "pay for deletion" route, at that place are a few things you need to keep in mind.

- If it's an one-time accuse-off, don't offer to pay the full amount due. Rather, you should try to negotiate for less than what they are request. Start with 50 per centum and get from in that location.

- Some creditors will claim they can't legally remove the accuse-off. This isn't true. Continue to negotiate until a deal tin be made.

- Yous can negotiate over the telephone, but e'er get the payment organization in writing before sending them a bank check or making an online payment.

- Never give a debt collector access to your banking company account.

2. Use The Advanced Method to Dispute the Charge-Off

If you don't have the money to pay the balance in total, or if you tin't get the original creditor to remove the charge-off from your credit written report, it'due south fourth dimension to dispute the negative entry using a more avant-garde method. To dispute the entry yous'll kickoff need a copy of your current credit report. Because of the coronavirus pandemic, yous can get a free copy of your credit study each week instead of just once a yr. Visit AnnualCreditReport.com to get a free credit report from TransUnion, Experian, and Equifax.

When you accept your credit reports in hand, find the charge-off entry and look at every item to ensure everything is completely authentic. The key here is to be very specific. If anything is inaccurate y'all have the right to dispute the unabridged entry.

Here are a few details that you should exist verifying are accurate:

- Account Number

- Creditor Proper name

- Open Date

- Charge-off Engagement

- Payment History

- Borrower Names

- Residuum

If you find any data that isn't correct, write a letter of the alphabet to each of the three credit bureaus list the inaccurate information and stating you've plant incorrect data that needs to be corrected or removed. If the credit reporting agencies tin't verify the entry, they'll have to correct or remove the accuse-off in compliance with the Fair Credit Reporting Act. Sometimes the information simply can't be verified and the entry will be removed. Exercise notation, all the same, that if the charge-off is reported accurately, disputing it will not assist.

3. Have A Professional Remove The Charge-Off

Companies similar Lexington Law, Credit Saint, and Sky Blue have years of experience getting inaccurate and negative items removed, and may help speed up the process of repairing your credit.

If yous accept several items to remove, aren't able to commit dedicated time to do information technology yourself, or want an expert to assist guide you through the process, we recommend getting assistance from these experts. Here's our full list of recommended credit repair companies. Each visitor offers a free consultation to help determine how they can help you restore your credit.

Even if you pay several hundred dollars to a credit repair company like Lexington Police, Credit Saint, or Heaven Blue, y'all tin save even more by getting lower interest rates and building a more stable personal finance life.

Understanding Accuse-Offs

What Is A Charge-Off?

When you oasis't paid on an account for six months to a twelvemonth, a credit card issuer or other debt collectors will often mark your business relationship as a "accuse-off." This means the creditor has determined it'll likely never collect your debt. It considers the debt a business loss. The company can write off debt at revenue enhancement time.

Simply writing off the debt doesn't mean the creditor volition terminate its debt collection efforts. In fact, the visitor might even rent a third-party debt collector to handle the collection process. This is important to understand in case you're contacted by a collection bureau you don't recognize. Either the drove agency bought the debt from your original creditor and now wants to collect on information technology — or the bureau has been hired by your credit card issuer, lender, or creditor to collect the debt on behalf of the original creditor.

This can happen with credit card debt, unpaid personal loans, or even hospital bills. One or 2 late payments shouldn't event in a charge-off, just ongoing delinquency will eventually turn into a accuse-off.

How Does a Accuse-Off Affect Your Credit Score?

Once an account has been charged off, 2 things volition likely happen:

- Showtime, you're going to start receiving calls and letters from drove agencies attempting to collect the debt.

- Second, the account will be marked as a "charge-off" on your credit report.

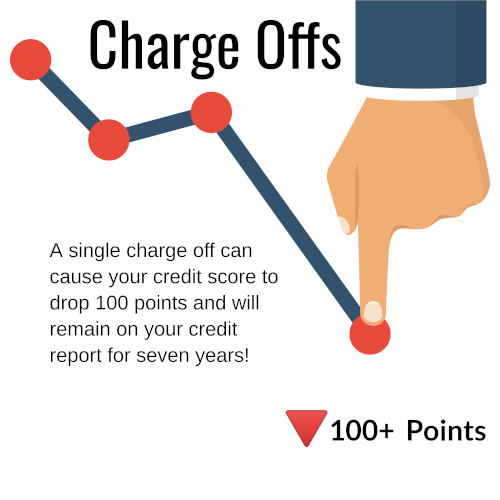

A charged-off business relationship on your credit report volition devastate your FICO score. A single charge-off can cause your credit score to driblet 100 points or more. It'due south a big deal.

In add-on to your credit score dropping, you're also going to have a actually difficult time getting approved for any new credit cards, mortgages, or motorcar loans. Lenders rarely extend credit to people with even ane charge-off on their credit report.

Paid vs. Unpaid Charge-Offs

There are two types of charge-offs that could appear on your credit written report. If you have paid the charged-off business relationship in full, the credit bureaus will mark the account as paid; if yous haven't it will remain marked as unpaid.

Will My Credit Score Better if I Pay the Charge-Off in Full?

Some collection agencies may try to convince y'all that paying off the full corporeality of your charge-off volition restore your FICO score. This is not true.A paid charge-off will definitely expect better to lenders who take the fourth dimension to do manual underwriting, but it will have a minimal effect on your credit score. Also, paying off the full charge-off won't automatically delete the entry from your credit report. Paying it off will not remove the charge-off from your account, either.

How Long Practise Charge-Offs Stay on Your Credit Report?

A accuse-off volition remain on your credit report for seven years, and and so it's automatically deleted. For example, if you stopped making payments on one of your credit cards for six months, and it was marked as a charge-off on Jan 1, 2022, it would remain on your credit report until Jan 1, 2027.

Fifty-fifty if the statute of limitations on the debt expires after iii or five years in your state, your credit report will still bear witness the charge-off, and your credit score will suffer. Statutes of limitations protect you from legal action but not from bad credit or from phone calls from debt collectors.

Sample Letter of the alphabet To Remove a Accuse-Off From Credit Report

Annotation: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states Charge-OFF or SERIOUSLY PAST DUE on your credit report.

[today'south date]

[original creditor or proper noun of drove agency if the account was sold]

[creditor accost]

RE: [account ex: Citibank Mastercard] account # [total business relationship number] (if contacting

a drove agency include the original acc. number, i.e., the Mastercard number in

this instance, and also include any acc. number assigned past the collection agency –this

number would be on one of your drove letters)

Dear Sir or Madam,

After recently reviewing my credit report, I took notice that the above-mentioned

business relationship is currently in [condition of account, ex: Charge-Off] status. I sincerely would

like to take care of this business relationship as soon as possible.

Due to [whatever caused you lot to exist late on your payments, ex: illness], I

unfortunately got behind on my payments and was unable to come across my obligations.

All the same, since and then my situation has greatly improved and I am in the position to

recompense this debt.

I am willing to pay [creditor'south proper name] [x payments a month] equalling the amount of

[total they are requesting] provided that the above business relationship is updated on all credit

reporting agencies to state: PAID AS AGREED, or completely removed from all credit

reporting agencies upon my terminal payment.

I am not agreeing to an updated credit written report that states this account as: "PAID

Accuse-OFF" or the like, as this will not significantly increase my credit score, nor

will information technology reflect my sincere willingness to restore my skillful name and hopefully,

someday, again practise business with your company.

Your written response will serve equally an agreement to my proposal and I volition begin

payments. Thank you very much for your valued time.

Best regards,

[get-go & last proper noun] [street address] [city, state, null code]

How To Repair Your Credit Report,

Source: https://bettercreditblog.org/remove-charge-off-credit-report/

Posted by: gillettemorselp.blogspot.com

0 Response to "How To Repair Your Credit Report"

Post a Comment